Novo Nordisk and Eli Lilly Resolve Supply Constraints

Following years of supply challenges, Novo Nordisk and Eli Lilly have made significant progress in addressing manufacturing bottlenecks for their GLP-1 drugs, such as Ozempic, Wegovy, and Mounjaro. Investments in production capacity have removed most drugs from the FDA’s shortage list, signaling a stronger supply chain heading into 2025.

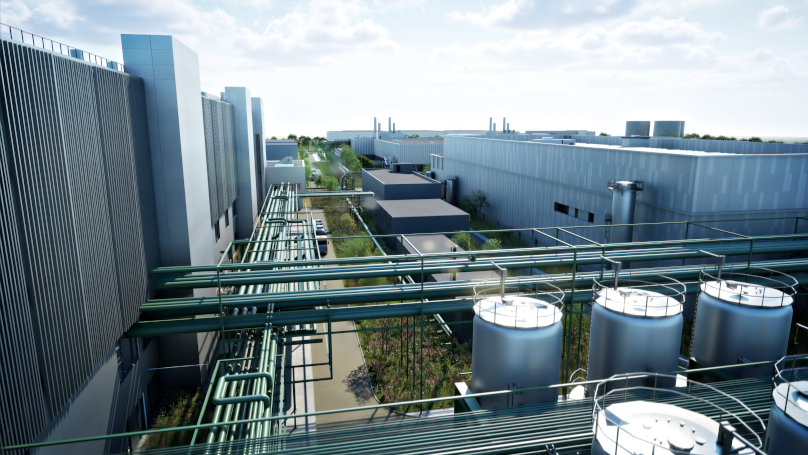

Major Manufacturing Investments Bring Stability

Both companies have invested billions to expand their manufacturing capacity:

- Novo Nordisk is building a $4.1 billion fill-finish plant in North Carolina, a $220 million raw ingredients facility, and a $409 million quality control hub in Denmark. Additionally, Novo’s acquisition of Catalent secures three new fill-finish sites.

- Eli Lilly has earmarked $5.3 billion for an active pharmaceutical ingredients plant and $4.5 billion for a new R&D and manufacturing facility in Indiana.

These projects emphasize not only capacity expansion but also network integration and quality control improvements, utilizing advanced data insights for efficiency.

Compounding Pharmacies Face New Dynamics

The resolution of shortages has sparked backlash from compounding pharmacies, which previously helped fill supply gaps. With branded GLP-1s becoming more accessible and competitively priced, patient demand may shift towards Novo and Lilly’s offerings, reducing the role of compounders.

Future Market Implications

As Novo and Lilly stabilize supply, emerging competitors are expected to adopt lessons from their rollouts. Targeting specific patient populations and investing early in manufacturing will be critical for new entrants aiming to capture a share of the GLP-1 market.

The manufacturing upgrades and strategic shifts better position Eli Lilly, Novo Nordisk, and new competitors coming into the GLP-1 space for growth and innovation in the years ahead.

For more information, please visit Fierce Pharma.